Alimony Tax Deduction: Is It Too Late To Divorce in 2018?

Have you heard the news about the alimony tax deduction? It is going away for divorces finalized after December 31, 2018. But fear not! If you and your spouse act smartly and quickly, you can still lock in your alimony tax deduction.

What is the Alimony Tax Deduction?

The alimony tax deduction is currently enshrined in 26 U.S. Code section 215. It states that alimony (as opposed to child support or distribution of property) can be tax deductible to the payor and taxable to the payee. This means that the person who pays alimony will pay less in taxes, and the person who receives alimony will pay taxes on it as if it were regular income.

What Counts as Alimony?

According to IRS Topic 452, alimony for tax deduction purposes has all of the following characteristics:

- The spouses don’t file a joint return with each other;

- The payment is in cash (including checks or money orders);

- The payment is to or for a spouse or a former spouse made under a divorce or separation instrument;

- The divorce or separation instrument doesn’t designate the payment as not alimony;

- The spouses aren’t members of the same household when the payment is made (This requirement applies only if the spouses are legally separated under a decree of divorce or of separate maintenance.);

- There’s no liability to make the payment (in cash or property) after the death of the recipient spouse; and

- The payment isn’t treated as child support or a property settlement.

IRS Topic 452 specifically states that the following payments would not be eligible for the alimony tax deduction:

- Child support;

- Noncash property settlements, whether in a lump-sum or installments;

- Payments that are your spouse’s part of community property income;

- Payments to keep up the payer’s property,

- Use of the payer’s property; or

- Voluntary payments (that is, payments not required by a divorce or separation instrument).

What is the Purpose of the Alimony Tax Deduction?

Let’s face it. Nobody wants to pay money to an ex-spouse. However, the alimony tax deduction provides an incentive to the payor as he or she would ultimately pay less in taxes.

Further, because the payor is likely to be in a higher tax bracket than the recipient of alimony, the federal government gets less revenue and more money stays within the family. An article from Forbes.com describes how this works:

Here’s an example: Say a spouse is required to pay $10,000 a month as alimony (or spousal maintenance) and is in the 50% tax bracket, including state and local taxes, and the spouse receiving the alimony is in the 30 to 35% tax bracket. A payment of $10,000 per month in alimony would result in a net payment of $5,000 a month for the spouse paying it. The spouse receiving the alimony might owe only $3,000 in tax on the money. Since the person getting the alimony would receive a net payment of $7,000 per month while the person providing it is paying only a net $5,000, the government is supporting the spouse receiving the alimony to the extent of $2,000 a month.

It’s Not Too Late To Get The Alimony Tax Deduction

Any divorce finalized in 2019 or later will not be eligible for the alimony tax deduction. However, if your divorce is finalized before the New Year, under the new law your alimony tax deduction will continue in perpetuity. This means, if you get a final judgment of dissolution of marriage on or before December 31, 2018, you will get a tax deduction for your alimony payments in 2018, 2019, 2020, and beyond.

The only problem is that the traditional divorce process can take months and months. If you go down the traditional adversarial path, by the time your divorce is finalized and a judge decides how much alimony should be paid, it will be too late.

Fortunately, there are alternatives. Collaborative divorce and mediation are two options that tend to go much faster than traditional litigation. If you and your spouse are looking to finalize your divorce sooner rather than later, these are two of your best bets.

So, if you want to be eligible for the alimony tax deduction, you should act smart and act fast. Resolve your families’s issues peacefully and privately via collaborative divorce or mediation.

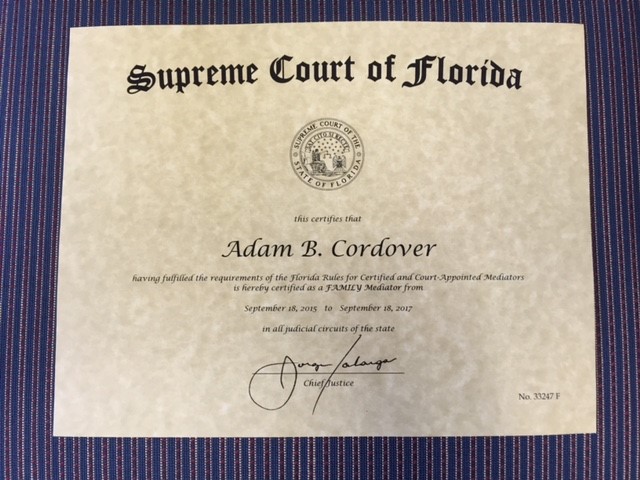

Adam B. Cordover is a collaborative attorney, collaborative trainer, and Florida Supreme Court Certified Family Law Mediator. He is editor of Building A Successful Collaborative Family Law Practice, newly published by the American Bar Association.